China Pathfinder: Q1 2023 Update

China reopened its borders in the first quarter of 2023 and rolled out the rhetorical welcome mat for foreign investors. This included pledges to promote foreign investment and imports, restoration of suspended long-term visas, and high-level visits by Chinese leaders abroad and foreign leaders in China. But an aggressive public campaign to allay concerns about the direction of China’s economy has not been underpinned by a convincing shift in policy. The restructuring plan that emerged from the “Two Sessions” meetings in March did not reassure the private sector, nor did it suggest that Beijing is poised to tackle the root causes of its macroeconomic malaise

Meanwhile, pressure on foreign companies (Bain, Mintz Group, Deloitte, Micron and others) further dampens business confidence. Heightened geopolitical tensions with the US also cloud the picture. Turning a cold shoulder to perceived American hostility, Beijing sought to warm relations with Europe: it had success with French President Macron, but faced setbacks at the European Commission, including a universally condemned comment by China’s ambassador to France that some European nations aren’t sovereign.

The bottom-line assessment for Q1 2023 finds that Chinese authorities were active in three of the six economic clusters that make up the China Pathfinder analytical framework: financial system development, competition policy, and portfolio investment. There were fewer developments in the innovation, trade, and direct investment clusters. In assessing whether China’s economic system moved toward or away from market economy norms in Q1, our analysis shows a negative picture.

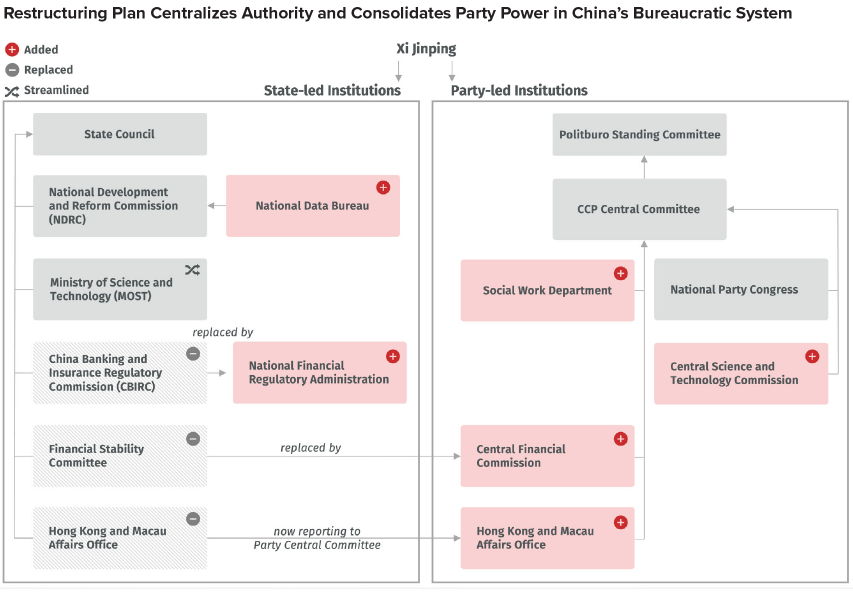

At the 2023 Two Sessions, the government released a major restructuring plan, involving the establishment of new departments, consolidation of responsibilities, and an overhaul of the financial system. While the extensive nature of this restructuring may suggest the government is focused on maximizing efficiency in the economy to boost growth, the reality is more complex and less positive. Rather than implementing policies that address systemic problems in the country’s economy—such as the fragile property sector, the loss of consumer and business confidence following destabilizing zero-COVID measures and unpredictable government intervention in different sectors, and high levels of local government debt—the restructuring plan overall does not enhance transparency and only increases Party control within the bureaucratic system.

Restructuring plan centralizes authority and consolidates party power in China’s bureaucratic system

Source: Rhodium Group. This chart is not intended to be comprehensive and only encapsulates relevant changes to the bureaucratic structure. For instance, the Central Military Commission is excluded from this diagram for simplicity.